Today, expense data rarely enters the organization through structured finance portals. Instead, employees increasingly submit receipts as PDFs through collaboration tools. As a result, finance teams struggle to keep pace with manual review, delayed approvals, and inconsistent ERP updates. MuleSoft expense automation directly addresses this challenge by managing document intake, data capture, policy checks, and ERP posting within a single, governed workflow.

More importantly, by combining API-led connectivity with Intelligent Document Processing, enterprises can transform raw receipt uploads into accurate, auditable financial transactions. Consequently, finance teams gain speed, accuracy, and operational control without adding headcount.

Why Traditional Expense Processing Breaks at Scale

Historically, expense workflows relied on portals and forms. However, collaboration platforms have significantly changed user behavior. For example, employees now upload receipts directly in Slack or Microsoft Teams, expecting fast turnaround and minimal effort.

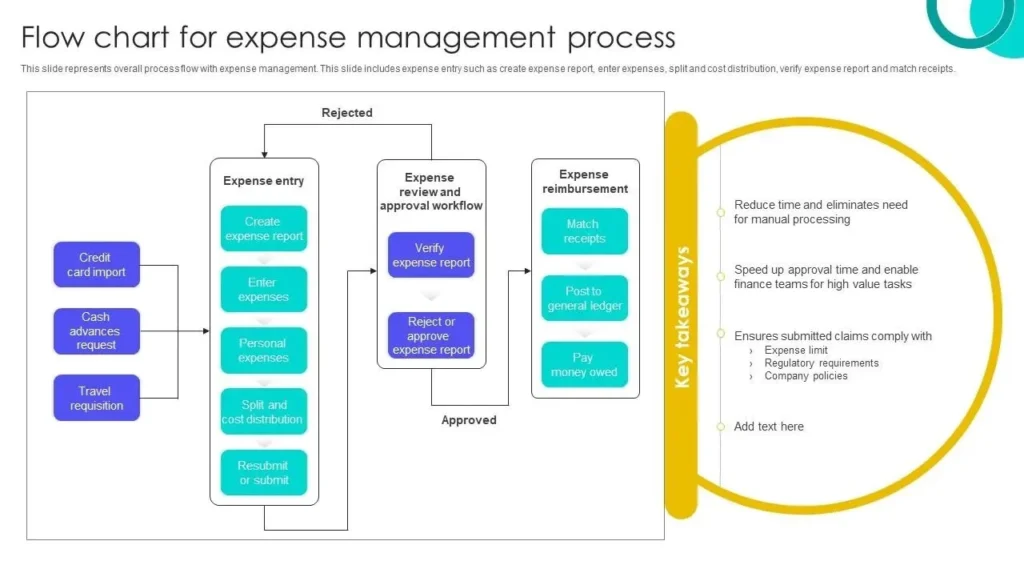

Nevertheless, downstream finance systems still require structured data. Therefore, finance teams must manually review PDFs, rekey expense details, and resolve inconsistencies. As a result, organizations experience:

- Slower reimbursement cycles

- Higher error rates in ERP systems

- Inconsistent policy enforcement

- Limited audit transparency

Ultimately, without automation, expense processing becomes a repeated source of delays.

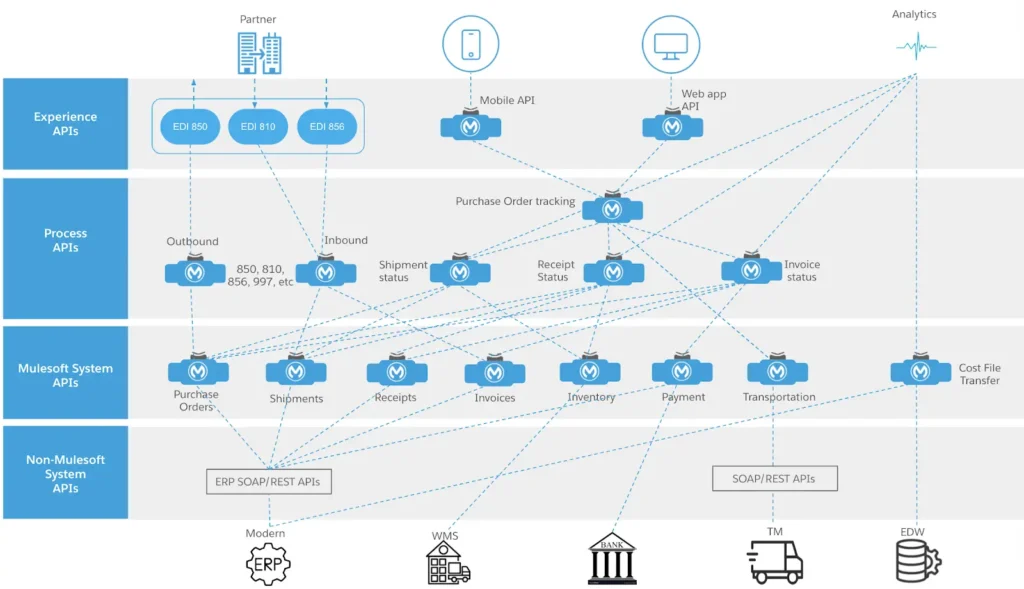

MuleSoft Expense Automation Architecture Overview

At the center of this approach is MuleSoft, which acts as the central integration layer between collaboration tools, AI services, and ERP platforms. Instead of point-to-point integrations, MuleSoft supports an API-led architecture that grows with the business.

Step 1: Receipt Ingestion from Slack or Teams

First, when a user uploads a receipt PDF in Slack or Teams, an event triggers a MuleSoft flow. Immediately, the integration captures key details such as user identity, submission time, and expense category. As a result, teams can track each expense from the start.

At the same time, MuleSoft normalizes the input, ensuring consistent downstream processing regardless of source platform.

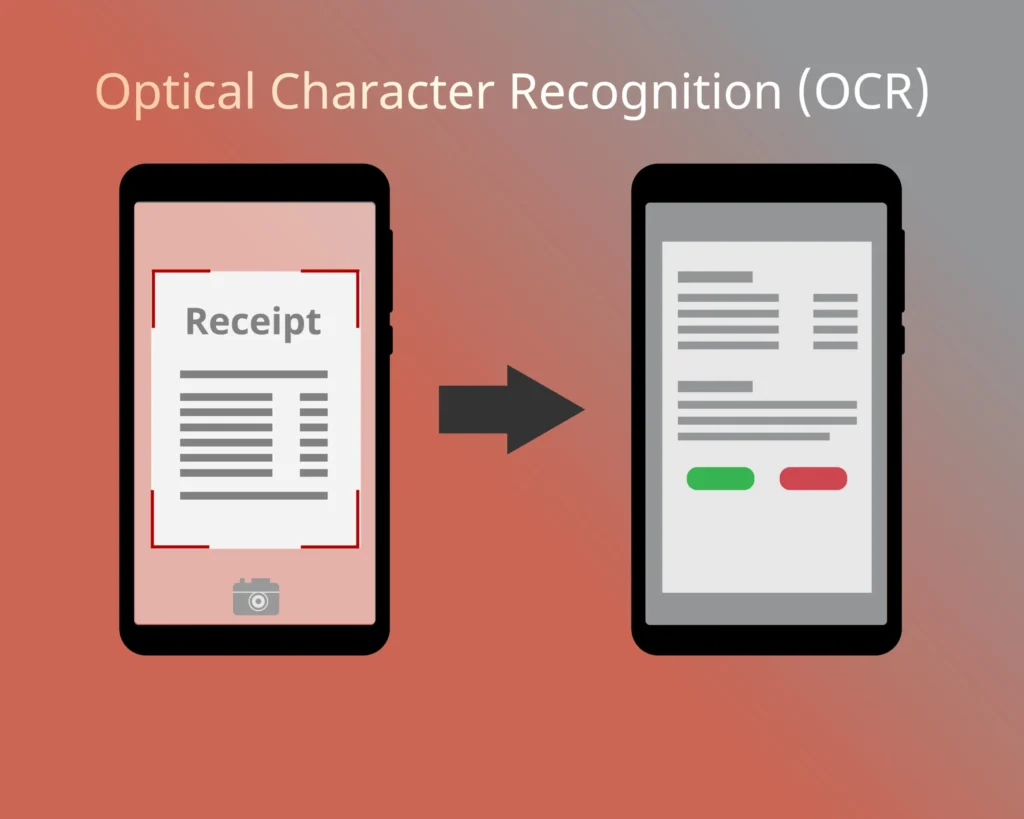

Step 2: Intelligent Document Processing for Expenses

Next, the system routes the document to an Intelligent Document Processing engine. Machine learning models then extract key expense fields, including:

- Merchant name

- Transaction date

- Total amount and currency

- Tax values and line items

Meanwhile, confidence scores are generated for each extracted field. Consequently, low-confidence documents can be flagged for review, while high-confidence expenses proceed automatically.

Step 3: Policy Validation and Business Rules

After extraction, MuleSoft applies centralized business rules. For instance, it validates spend limits, detects duplicates, and maps expense categories. Because these rules live in the integration layer, policy updates can be deployed quickly without modifying ERP configurations.

Therefore, finance teams maintain governance while avoiding system complexity.

Step 4: ERP Posting and Financial Integration

Finally, validated expense data is transformed and posted into financial systems such as SAP or Oracle. During this step, MuleSoft ensures schema compatibility, transactional integrity, and robust error handling.

As a result, ERP records remain accurate, complete, and audit-ready.

Key Advantages of MuleSoft Expense Automation

MuleSoft expense automation delivers value beyond simple connectivity.

API-Led Design for Long-Term Flexibility

Because APIs separate systems, processes, and user experiences, each layer can evolve independently. Consequently, organizations can introduce new IDP engines, collaboration tools, or ERP upgrades without rearchitecting the entire workflow.

Built-In Governance and Compliance

Additionally, centralized logging, retry logic, and exception handling provide end-to-end visibility. Therefore, audit requirements are met without embedding custom logic in core finance systems.

Scalable Finance Transformation

Once expense processing automation is in place, the same architecture can extend to invoices, purchase orders, and vendor onboarding. As a result, finance automation initiatives accelerate rather than stall.

Measurable Business Impact

Organizations implementing MuleSoft expense automation consistently achieve:

- Faster reimbursements, which improves employee satisfaction

- Lower manual processing costs, thereby reducing finance overhead

- Higher data accuracy in ERP systems

- Stronger compliance and audit readiness

Most importantly, finance teams shift from transactional work to strategic analysis.

How NJC Labs Implements MuleSoft Expense Automation

NJC Labs designs MuleSoft expense automation solutions aligned with enterprise finance architectures. From Slack and Teams ingestion through IDP selection and ERP integration, each implementation emphasizes scalability, governance, and operational resilience.

Moreover, by treating expense workflows as reusable integration assets, organizations establish a foundation for broader financial transformation.