Financial services organizations depend on accurate, up-to-date data to stay competitive and meet regulations. When data sits in disconnected systems, analytics efforts slow down. MuleSoft data integration helps finance teams easily access, share, and use data across the business without replacing existing systems.

By fixing data fragmentation early, banks and financial institutions can work more efficiently, gain insights faster, and deliver a more consistent customer experience.

Challenges for Financial Services Providers: Data Silos

Many banks and financial institutions use big data to improve decision-making and operational agility. However, isolated data repositories prevent teams from efficiently combining information from multiple internal and external sources.

As a result, reporting slows down, analytics quality suffers, and collaboration between departments becomes more complex. These challenges often intensify as organizations adopt new platforms, SaaS tools, and regulatory systems.

Addressing Data Silos with MuleSoft Integration

Data silos remain a persistent issue in banking, which is why many institutions adopt MuleSoft integration services. MuleSoft enables organizations to segment, connect, and standardize fragmented data while promoting collaboration across internal systems.

To fully realize the value of data analytics services, financial institutions must first resolve siloed architectures. MuleSoft data integration provides a scalable foundation for doing so.

Using Salesforce powered MuleSoft further enhances the banking experience by enabling secure, real-time access to siloed data. This approach supports consistent data flows across customer, operations, and risk systems.

Understanding Data Silos

Data silos are a major barrier to digital transformation, with 89 percent of IT leaders acknowledging their negative impact. A data silo refers to information that is accessible only to a specific department or team.

These silos typically exist across databases, legacy systems, and modern applications. Consequently, even organizations with advanced data engineering capabilities struggle to generate unified insights. For example, while a finance strategist may analyze customer behavior across channels, fragmented systems limit visibility and accuracy.

Prioritizing MuleSoft data integration helps organizations centralize access while preserving system ownership and governance.

Breaking Down Data Silos in Banking

Recent research shows that 39 percent of data-driven enterprises manage more than 50 data silos. In banking environments, complex hierarchies and layered approval processes further restrict data accessibility.

By implementing MuleSoft Salesforce integration with support from experienced data integration specialists, financial institutions can simplify data exchange and improve transparency across teams.

Managing Legacy Data

Legacy systems often contribute heavily to data silos. These platforms store valuable historical data but lack the flexibility required for modern analytics and real-time access.

MuleSoft connects legacy systems with modern applications, enabling secure data exposure without full system replacement. As a result, banks extend the value of existing investments while modernizing their data architecture.

Overcoming Data Exchange Barriers

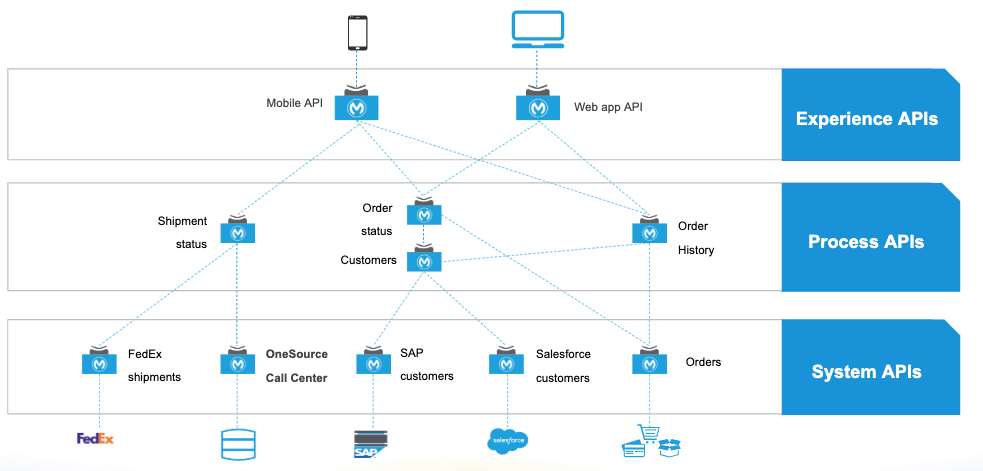

Disconnected banking applications reduce operational efficiency and, as a result, negatively impact customer service. MuleSoft API-led connectivity addresses this challenge by enabling standardized, reusable APIs across both cloud and on-premises environments.

This approach eliminates brittle point-to-point integrations and ensures consistent data availability across the organization.

Managing Siloed Data with MuleSoft Salesforce Integration

MuleSoft uses API-led connectivity to streamline data sharing across applications, tools, systems, and platforms. In addition, Robotic Process Automation supports automated data extraction from siloed sources.

Together, these capabilities improve operational efficiency, support customer relationship management, and reduce manual data handling across finance teams.

Best Practices for Using MuleSoft Salesforce to Break Down Data Silos

MuleSoft Anypoint Platform and its pre-built connectors support secure, scalable API integration across internal systems and third-party platforms.

Promoting Smooth and Secure Data Sharing

Financial organizations should prioritize collaboration across departments, applications, and data environments. MuleSoft integration automates secure data access through standardized APIs, integration workflows, and automation capabilities.

Achieving a ‘Golden Source’ – A Unified View of Data from Multiple Sources

MuleSoft Salesforce integration enables a consolidated, enterprise-wide view of data. This unified perspective improves transparency, strengthens trust between teams, and supports consistent reporting and analytics.

Opting for Data Integration Services

MuleSoft enterprise integration tools support automated data extraction, transformation, and segregation when connecting new databases. This approach improves scalability, enhances security, and lowers long-term integration costs.

Focusing on Data Security

MuleSoft Salesforce strengthens financial risk analysis and governance through layered security controls. These features protect sensitive data while supporting compliance with regulatory requirements.

Adopting API-led Connectivity

Secure, reusable APIs provide real-time data access while reducing integration complexity. API-led connectivity addresses the high costs and productivity challenges commonly associated with siloed data environments.

Data Management in Action with NJC Labs

NJC Labs works with banking and wealth management organizations to eliminate data silos and modernize data operations.

In one engagement with a high-profile banking provider, NJC Labs helped reduce technical debt, onboard multiple SaaS platforms rapidly, and accelerate the adoption of open banking standards at the API level. The result was faster innovation cycles and consistently positive customer feedback across MuleSoft-powered touchpoints.